Glenn reinforces the importance of an eStrategy process and tracking your resources with an attribution model.

(no CEUs offered for this webinar)

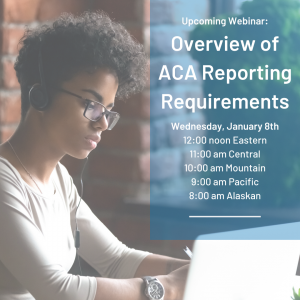

vides an overview of 2019 ACA reporting requirements that are applicable for both large employers and self-insured plans. Stacy will review the various reporting forms (1094-B, 1095-B, 1094-C, and 1095-C), indicator codes and affordability safe harbors. Other topics covered in this webinar include how to report for waiting periods / initial measurement periods, COBRA participants and post-employment coverage, and how to correct reporting mistakes. Stacy will also address common questions and provide best practices.

vides an overview of 2019 ACA reporting requirements that are applicable for both large employers and self-insured plans. Stacy will review the various reporting forms (1094-B, 1095-B, 1094-C, and 1095-C), indicator codes and affordability safe harbors. Other topics covered in this webinar include how to report for waiting periods / initial measurement periods, COBRA participants and post-employment coverage, and how to correct reporting mistakes. Stacy will also address common questions and provide best practices.Glenn reinforces the importance of an eStrategy process and tracking your resources with an attribution model.

(no CEUs offered for this webinar)